29

Apr

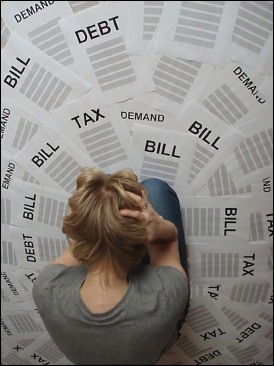

How many people do you know that constantly complain about their debt? Perhaps you are guilty of doing this yourself. If so, ask yourself what you are really doing to get rid of the problem. Sadly, many people just aren’t willing to make the major life changes that are necessary to actually get rid of their debt. Undoubtedly, it’s a lot easier to sit back and complain about how stressful your debt is than to do what needs to be done to get that debt down to zero.

How many people do you know that constantly complain about their debt? Perhaps you are guilty of doing this yourself. If so, ask yourself what you are really doing to get rid of the problem. Sadly, many people just aren’t willing to make the major life changes that are necessary to actually get rid of their debt. Undoubtedly, it’s a lot easier to sit back and complain about how stressful your debt is than to do what needs to be done to get that debt down to zero.

There are a lot of little things that you can do to save a little bit of money. However, when it comes to dealing with major debt, you really do need to buckle down and make some big sacrifices. If you aren’t willing to make those sacrifices, you may find yourself still complaining about that bundle of debt twenty or thirty years from now. Sound frightening? Sometimes we need to get really scared about the seriousness of our debt problems before we’re willing to make the sacrifices necessary to really solve the problem.

Here is a look at five of the big things that you may need to sacrifice if you want to get serious about getting out of debt:

1. Your home.

The home that you own or rent is probably the biggest expense that you have. Nobody is suggesting that you make the drastic choice to become homeless in order to save money. However, you may want to think about giving up the home that you live in and moving to a more affordable place so that you can save enough money to get out of debt.

A large percentage of us live in homes with rooms that we don’t need. Each kid in the family does not need his or her own bedroom. You don’t actually need both an office and a living room. Start thinking about your needs versus your desires and move to a home that is more in line with the actual needs that you have.

You may also want to look at the location of your home. Some cities are more expensive than others. Some people are living so far from work that their commute costs are exorbitant. It may make sense to move to a cheaper geographic location if you’re in serious debt that needs to be dealt with.

Giving up the home that you live in can be one of the most difficult sacrifices that you will make. It means creating a sense of instability in your life for a time, adjusting to a new home and getting used to a smaller space. However, real debt means making some real sacrifices and giving up the luxuries of a home you love can seriously reduce the amount of money that you spend each month.

2. Your car.

For some people, a car can be a really big expense that is merely contributing to their overall debt. Your car costs you money in terms of insurance coverage, gas and repairs. You may also be spending money on a car payment. Make the sacrifice of giving up your car and you’ll be able to put all of that money towards paying off your outstanding debt.

Once you’ve paid off those old bills and saved up some money then you can go back to enjoying the luxury of a car. Believe it or not, it really is a luxury. We don’t think of it that way in modern society but a car isn’t a necessity. If you live in a home with two cars, it’s practically a given that you should give up one of them. Perhaps you should even consider giving up both of them.

Yes, it will mean that you have to walk or take the bus. That’s one of the sacrifices that you should make if you are serious about eliminating your debt. By the time your debt is gone, you may find that you actually enjoy walking more than you thought you would!

3. Your vices.

Your bad habits may not cost you as much as your home and your car but they probably do make up a large percentage of your extra spending money. The cigarettes that you shouldn’t be smoking, the alcoholic drinks that you pay too much for at the local bar … these are the things that we do because we enjoy them but they aren’t necessary for our lives. In fact, it could be argued that these things have a negative impact on our lives. They certainly have a negative impact on our wallets and someone who has a lot of debt can’t handle any more dings to their wallet.

Make a pact with yourself to sacrifice all of your vices and to put the money you save directly into a fund that pays off your debt. This will prevent you from wasting that money on new vices (buying cookies instead of cigarettes or soda instead of alcohol, for example). Make a list of all of the things that you spend money on that aren’t good for you and commit to not spending money on them when you’re still struggling to get out of debt.

4. Travel

Almost everyone loves to travel. Many of us do what we can to enjoy frugal travel. But even if we do all that we can to save money, travel usually costs something. That’s an indulgence that you ought to consider sacrificing if you’re serious about getting rid of your debt.

5. Your free time

Nobody wants to sacrifice their free time but that might be exactly the sacrifice that you need to make if you are ever going to really get rid of that mountain of debt that you’re living under. The fact of the matter is that you can only save a certain amount of money by living frugally and making these other sacrifices. At some point, the amount that you can save taps out. When that time comes, the only answer to getting rid of more debt is to start taking in more income.

You don’t necessarily have to take on a second job outside of the home in order to generate more income. You could start a home-based business. You could start blogging for a little bit of revenue and affiliate income. You could baby-sit or tutor kids from your home. These things will require you to sacrifice some of your free time but they’ll help you to get rid of your debt more quickly. Once your debt is gone, you’ll have more free time than you did before because you won’t be constantly struggling to catch up to those bills.

The unfortunate reality of debt is that it’s not easy to get rid of it. The due dates on those bills come around faster than it seems like they possibly should and interest is added on to the principal balance each month. It can sometimes feel like you’ll never be done paying for stuff that you purchased long ago.

The good news is that debt can be dealt with. Many people have worked hard and made big sacrifices in order to eliminate their debt. And those people report that living a debt-free life is well worth the sacrifices that they had to make to get there. But it does require you to be willing to make those sacrifices. Are you willing to do that? Or do you just want to sit around and whine about the problem?

Hey, seems you’re new here, you may want to subscribe to our RSS feed, so you will be the first to get our free money saving tips. Also this post is worth reading 100 Tips for Talking about Money with your Spouse, Family and Friends. Thanks for visiting!

Leave a Response